-

Corporate Governance Report (June 30, 2025)

(397KB)

Corporate Governance Report (June 30, 2025)

(397KB)

-

GS Yuasa Report 2025 - Governance

(1,537KB)

GS Yuasa Report 2025 - Governance

(1,537KB)

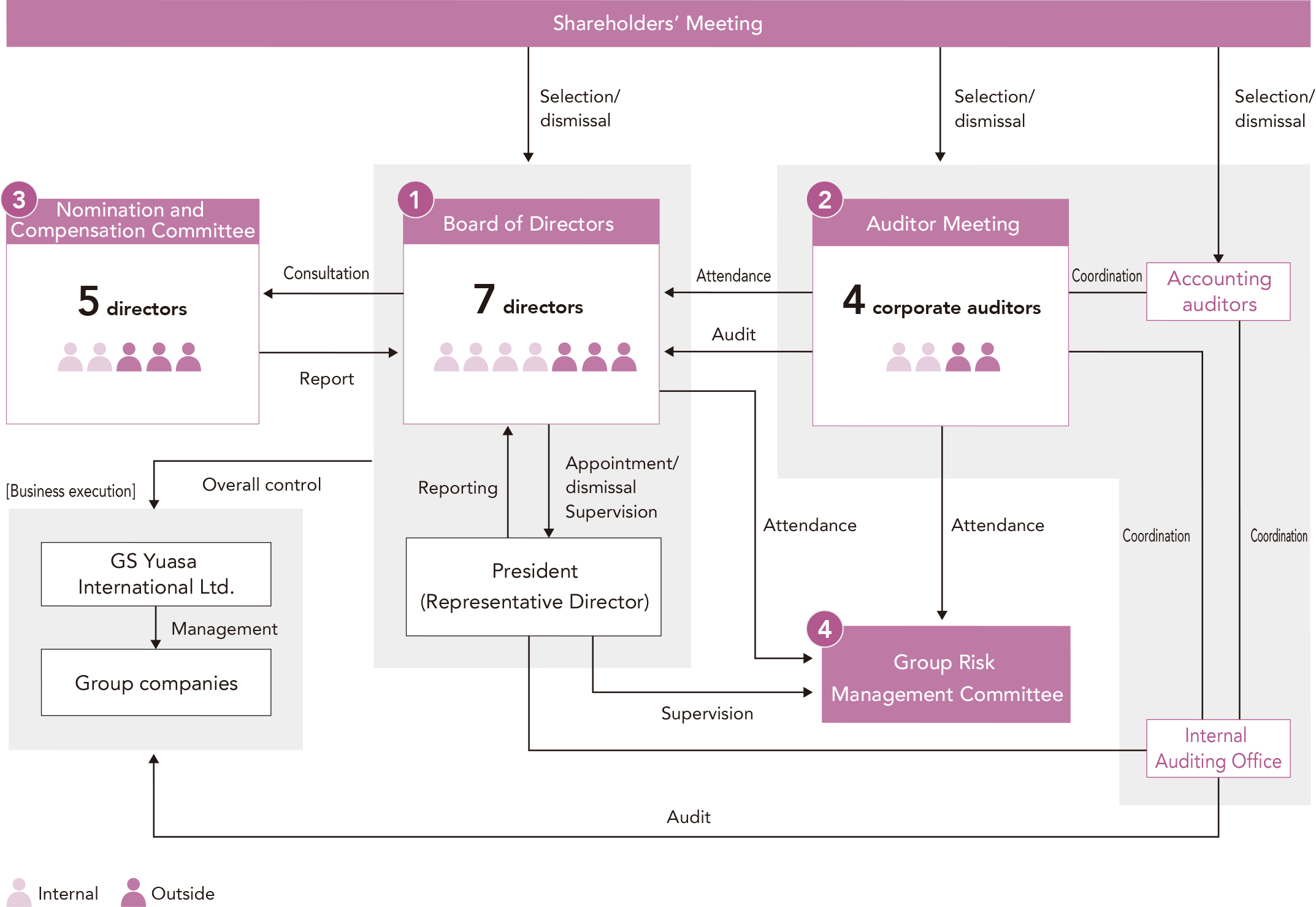

To drive sustainable growth and enhance corporate value over the medium to long term, the Group is committed to establishing an organization and systems that enable fast, efficient responses to a changing business environment. At the same time, our basic policy on corporate governance is to make every effort to thoroughly implement and strengthen compliance and improve the soundness and transparency of management.

Based on this philosophy, GS Yuasa Corporation, a pure holding company, is responsible for formulating management strategies for all of the Group’s businesses, as well as management for the entire Group and oversight of the Group’s business execution. GS Yuasa International Ltd., the Group’s core operating subsidiary, is the key decision-making body for business execution, consolidating and strengthening business execution and enhancing dynamism in the execution of business.

In this manner, functions are divided between GS Yuasa Corporation and GS Yuasa International to enhance and reinforce management structures while establishing governance structures that can increase the transparency and efficiency of management.

■Governance Structure (FY2025)

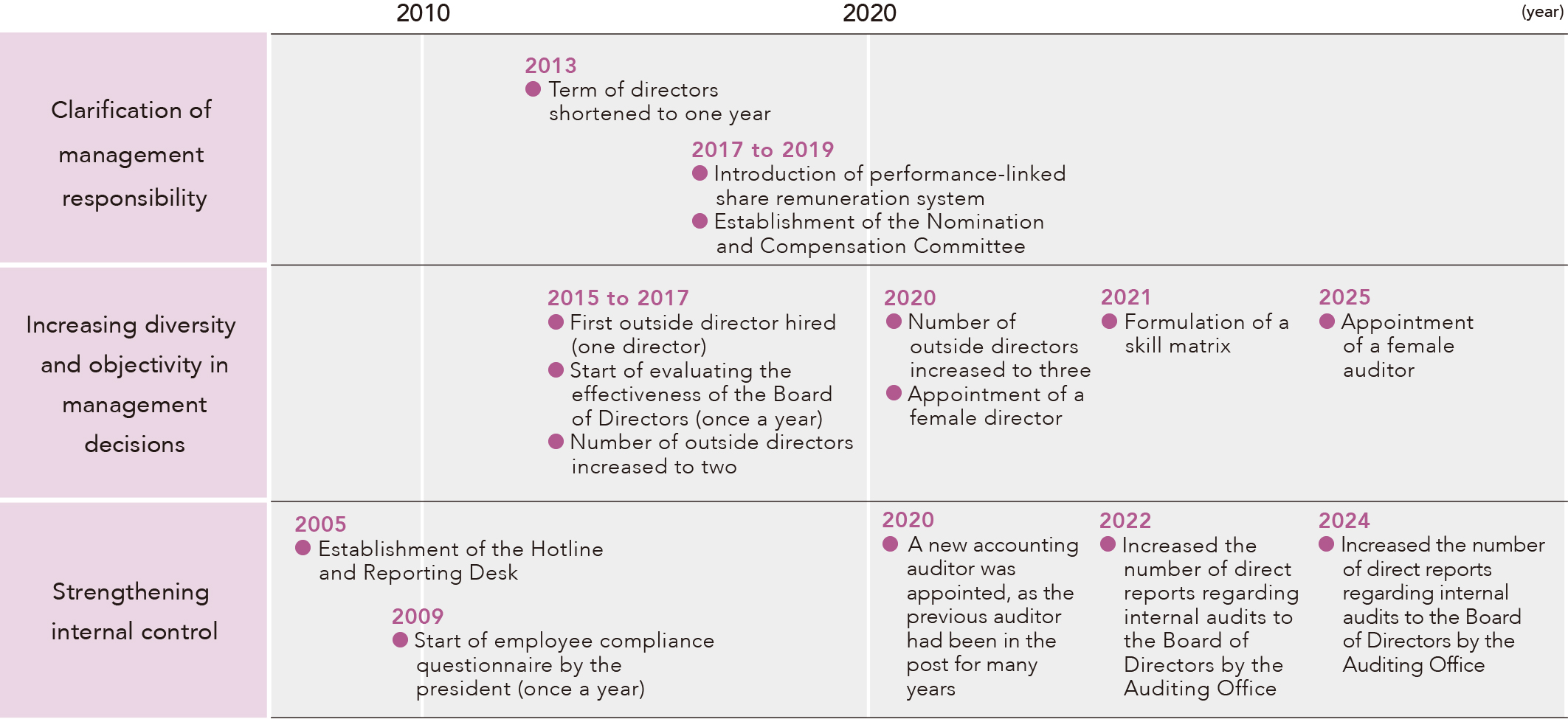

■Efforts to strengthen corporate governance

The Company implements all the principles established in the Corporate Governance Code.

As an institutional design of corporate governance, we have adopted the "Company with a Board of Corporate Auditors" system.

The Board of Corporate Auditors consists of four corporate auditors, including two outside corporate auditors who are independent of management, and is chaired by a full-time corporate auditor. The Board of Corporate Auditors meets monthly in principle to monitor the appropriateness of the decision-making process of directors and the status of management execution. Corporate auditors attend important meetings (Board of Directors meetings, Group Risk Management Committee meetings, etc.) to provide opinions and recommendations, and appropriately fulfill their monitoring function to realize sound management through audits based on audit policies, allocation of duties, etc. They also receive reports from the accounting auditors on the audit system and audit plans, the status of audit implementation, and the content of audits. They confirm audit methods, audit status, etc. by accompanying or remotely monitoring the accounting auditors on their visits to group companies. In addition, the corporate auditors receive explanations of audit plans and reports on audit results from the internal audit department. In addition, corporate auditors regularly exchange opinions with the president and outside directors. The corporate auditors work closely and regularly with the accounting auditors and the internal audit division to improve the effectiveness and efficiency of audits of the directors' performance of their duties. The Board of Corporate Auditors convened 14 times during fiscal year 2024.

■Major Items Discussed by the Board of Corporate Auditors

- Establishment of audit policy and audit plan

- Preparation of audit report

- Reasonableness of the accounting audit

- Evaluation of accounting auditors and agreement on remuneration

- Status of establishment and operation of internal control system

- Audit of the contents of general meeting of shareholders proposals

- Consent to the nomination of candidates for corporate auditor

■Major Sources of Information in Audits by Corporate Auditors

- Hearing from directors and employees on the status of execution of their duties

- Inspection of important documents, such as important approval documents and resolution documents

- Investigating the status of assets

- Reports from directors and employees at important meetings on the status of business operations and risk management

On February 26, 2019, the Board of Directors voted to establish a discretionary Nomination and Compensation Committee, chaired by an independent outside director, and serving as an advisory body to the Board of Directors. The goal of the committee will be to strengthen the independence, objectivity and accountability of Board of Director functions such as director nominations and compensation. Nomination committee functions include consulting on proposals for nominating new directors and for selecting a new corporate president and plans for successors (including human resource development), in addition to reporting findings to the Board of Directors. Meanwhile, the compensation committee will consult on policy determinations for director compensation as well as for individual director remuneration, and reporting findings to the Board of Directors.

In fiscal 2024 there were 8 Nomination and Compensation Committee Meetings.

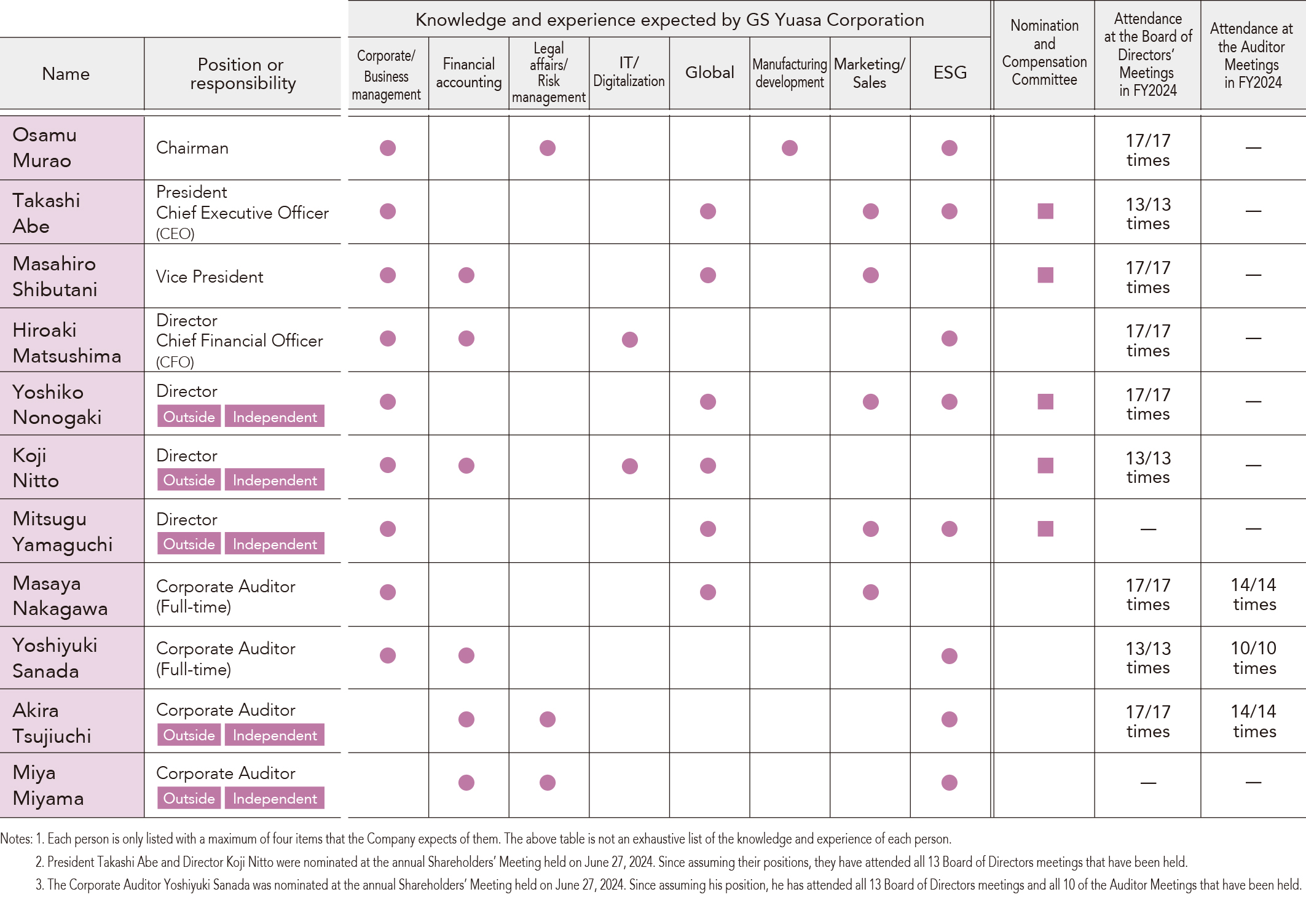

■Skills matrix of directors and auditors

To enable the Board of Directors to effectively fulfill its duties as the Board of Directors of the holding company, we select, in a well-balanced manner, persons with knowledge, experience, skills, and so on relating to the business of our Group as a whole and persons who can make statements and act from an objective standpoint and a long-term, wide-ranging perspective. In addition, we strive to achieve a size and composition that can reflect diverse opinions, including gender and international viewpoints.

The following describes the main themes and reports discussed during the Board of Directors’ meetings held in fiscal year 2024. This year's key themes included numerous discussions and reports concerning overseas business strategies and the BEV business. The Board of Directors held 17 meetings in fiscal year 2024.

■Main discussion points in FY2024 in Meetings of the Board of Directors

|

Matters relating to the Shareholders’ Meeting |

●Decision on convocation and agenda of the Shareholders’ Meeting ●Approval of business reports, financial documents, etc. ●Deciding of director nominations |

|

Matters relating to directors |

●Selection of president and executive directors ●Remuneration and bonuses of directors ●Directors serving concurrently at other companies |

|

Matters relating to management in general |

●Items in the Mid-Term Management Plan ●Matters relating to the Group’s business strategies ●Matters relating to capital procurement ●Matters relating to key business activities |

|

Others |

●Selection of members of the Nomination and Compensation Committee ●Implementation of appraisal of the Board of Directors’ effectiveness and report ●Reports relating to investor relations activities ●Verification of cross-shareholdings |

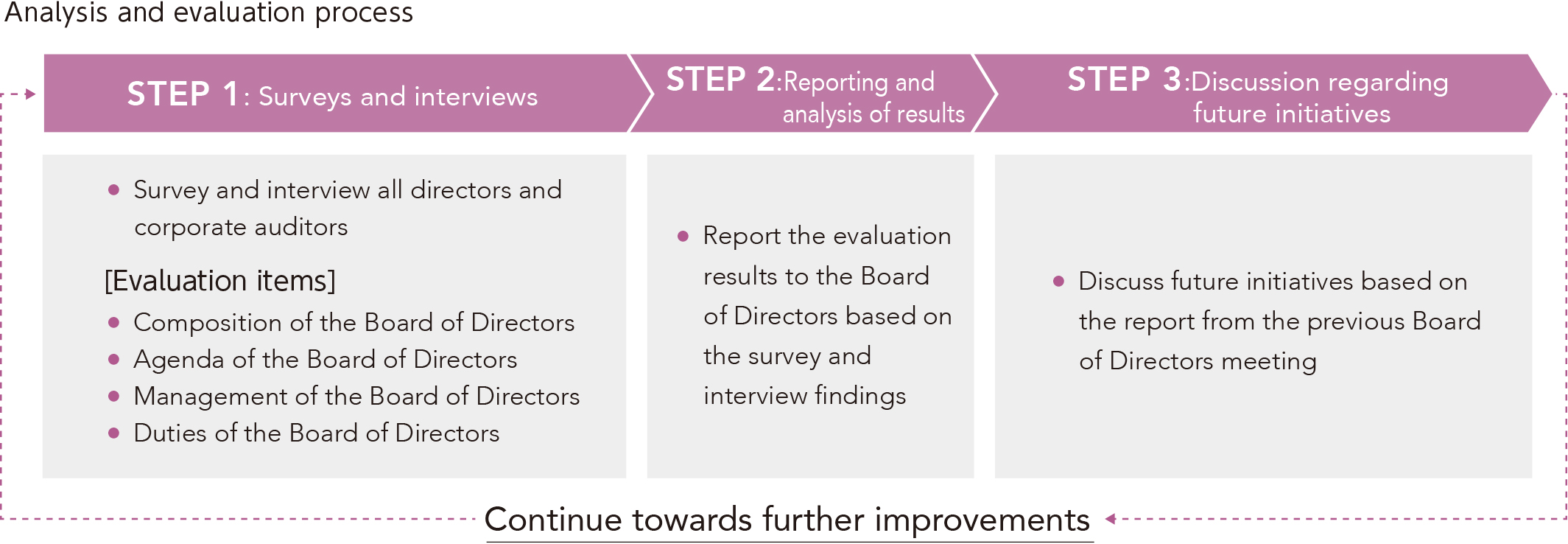

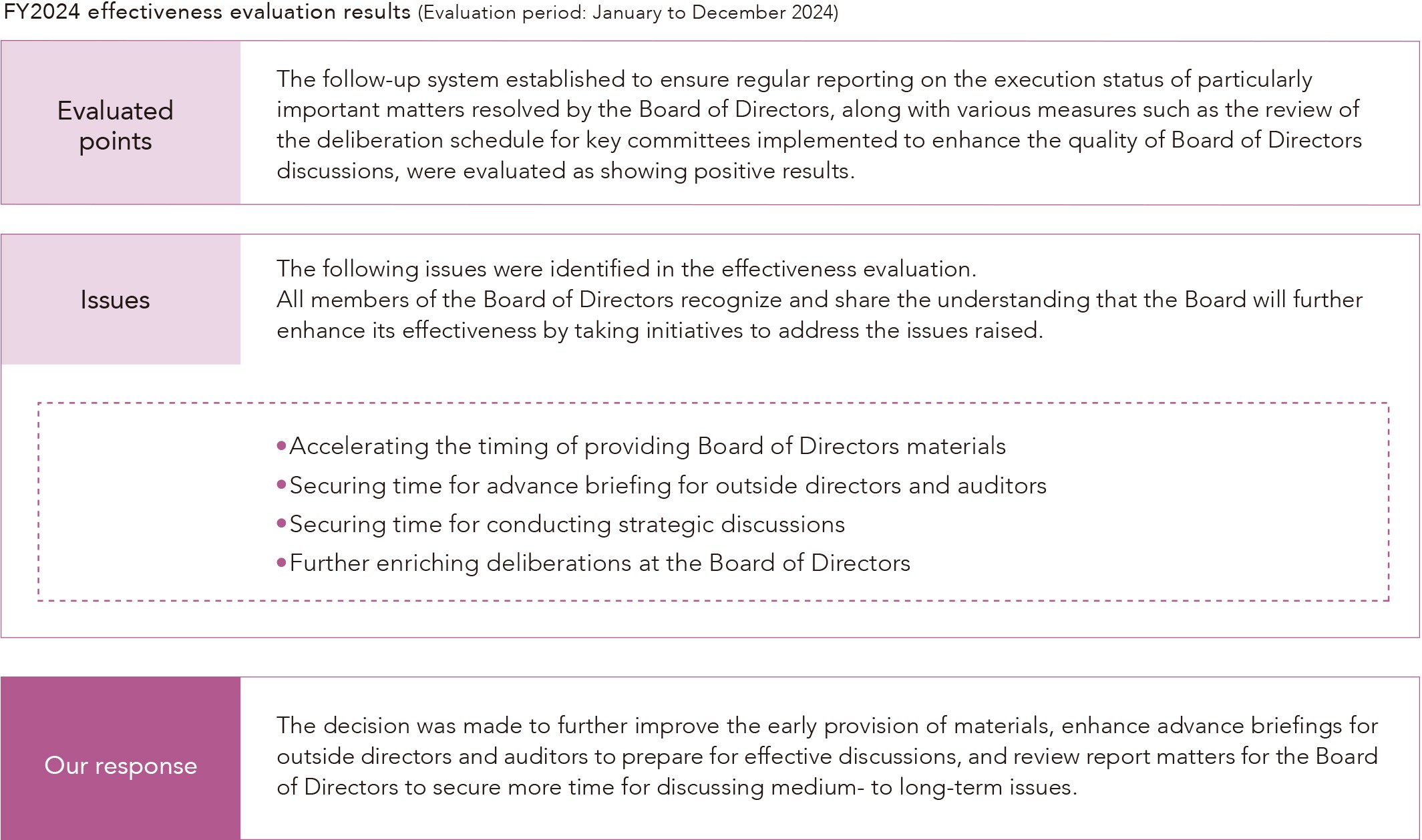

Once each year, the Company evaluates the effectiveness of its Board of Directors under the leadership of the outside directors and the president with the objectives of confirming whether the current situation is consistent with the ideal status of the Board and the roles it should fulfill, identifying areas for improvement, and further improving operation of the Board.

The Board then investigates and carries our improvement measures to address the issues that were identified through the evaluation. The Company will continue to evaluate the effectiveness of the Board and strive to make further improvements in the future.

■Evaluating the effectiveness of the Board of Directors

■Results of evaluation of effectiveness of the Board of Directors

■Reasons for nomination of, status of main activities of, and record of attendance by outside directors at Board of Directors and Auditor Meetings(FY2024)

|

Official position |

Name |

Reasons for nomination |

Status of main activities |

|

Director |

Yoshiko Nonogaki |

Ms. Yoshiko Nonogaki possesses broad insight for overseeing overall management, drawing from her operational experience within the business divisions of a globally expanding listed company, her management experience at overseas subsidiaries, and her experience as an outside director at a listed company. |

Ms. Yoshiko Nonogaki possesses extensive expertise and broad insight gained from her operational experience within the business divisions of a globally expanding listed company, her management experience at overseas subsidiaries, and her role as an outside director of a listed company. She provides valuable insights and recommendations across all aspects of management, particularly in objectively verifying the profitability and feasibility of new investment projects. Furthermore, she offers valuable recommendations, such as enhancing external accountability and explanatory power from an IR perspective, improving persuasiveness, thoroughly grasping the challenges and current status of each business, and strengthening concrete measures. As an independent outside director, She contributes to strengthening and improving our governance. This includes serving on the Nomination and Compensation Committee, providing various proposals regarding the effectiveness evaluation of the Board of Directors, and offering beneficial advice to our management on the utilization of human capital, including from a Diversity & Inclusion perspective. |

|

Director |

Koji Nitto |

Mr. Nitto Koji possesses broad insight for overseeing overall management, drawing from his experience as CFO of a globally expanding listed company and within its business divisions, as well as his experience as an outside director at a listed company. |

Mr. Koji Nitto possesses extensive experience and broad insight as a director of listed companies, drawing on his background as CFO of a globally expanding listed company, his experience within business divisions, and his tenure as an outside director at listed companies. He oversees overall management, particularly evaluating the profitability and feasibility of new investment projects from an objective perspective. He also focuses on clarifying the relationship between global strategy and individual projects, financial risks, and numerical substantiation, rigorously implementing the PDCA cycle. He provides valuable insights and recommendations regarding sustainable growth strategies with an eye toward the future. As an independent outside director, he has made various observations and proposals in the Nomination and Compensation Committee and in the evaluation of the effectiveness of the Board of Directors. Furthermore, he contributes to strengthening and improving our corporate governance by providing valuable advice to our management based on his expertise in ROIC management. |

|

Director |

Mitsugu Yamaguchi |

Mr. Mitsugu Yamaguchi possesses broad insight for overseeing overall management, gained from his experience as President and CEO of a publicly listed company with global operations. |

- |

|

Corporate Auditor |

Akira Tsujiuchi |

Mr. Akira Tsujiuchi possesses extensive experience cultivated as a certified public accountant and profound expertise in finance and accounting. |

Mr. Akira Tsujiuchi contributes to enhancing our Group's corporate governance by providing valuable opinions and recommendations based on his extensive experience as a certified public accountant, which has cultivated his broad insight, and his high level of expertise in finance and accounting. |

|

Corporate Auditor |

Miya Miyama |

Ms.Miya Miyama possesses extensive experience cultivated as an attorney and deep expertise in corporate legal affairs. |

- |

Candidates selected as outside directors must meet the requirements for independence set out in the Companies Act and possess the experience and insight to objectively and fairly judge the legality and appropriateness of the execution of the company's duties from the shareholders' perspective without being limited by being in charge of business implementation. We have also notified the Tokyo Stock Exchange that all of our outside directors are independent.

In selecting outside director candidates, in addition to their meeting the requirements for externality as stipulated in the Companies Act, the Company strives to determine whether they have the experience and insight to make objective and neutral judgments about the legality and appropriateness of the execution of the Company's business from the standpoint of shareholders, without being subject to restrictions imposed by the executive management.

Further, the Company believes that it is desirable to have human resources who are considered independent from the perspective of those outside the Company also, and for this reason, the Company uses the independence standards, etc. set forth by the Tokyo Stock Exchange, as a reference.

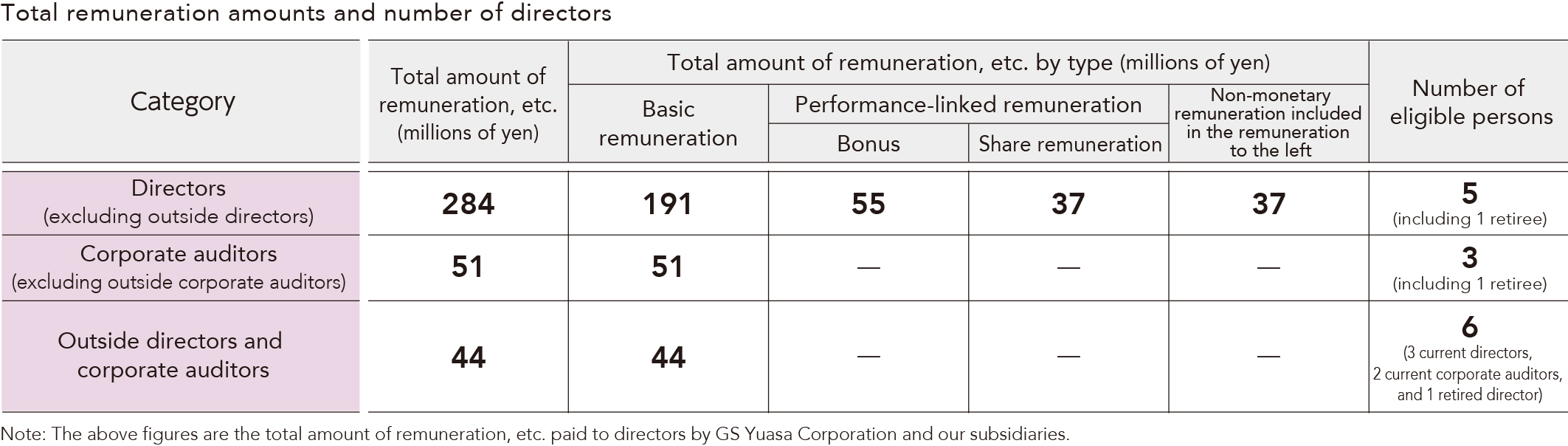

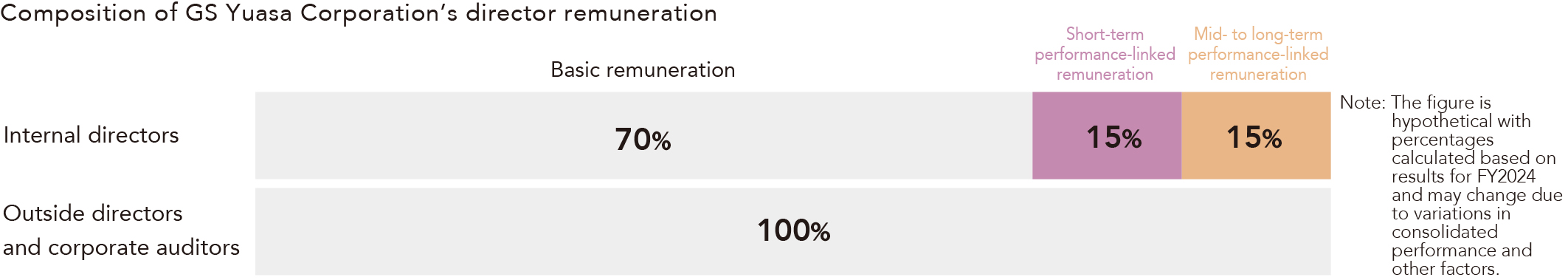

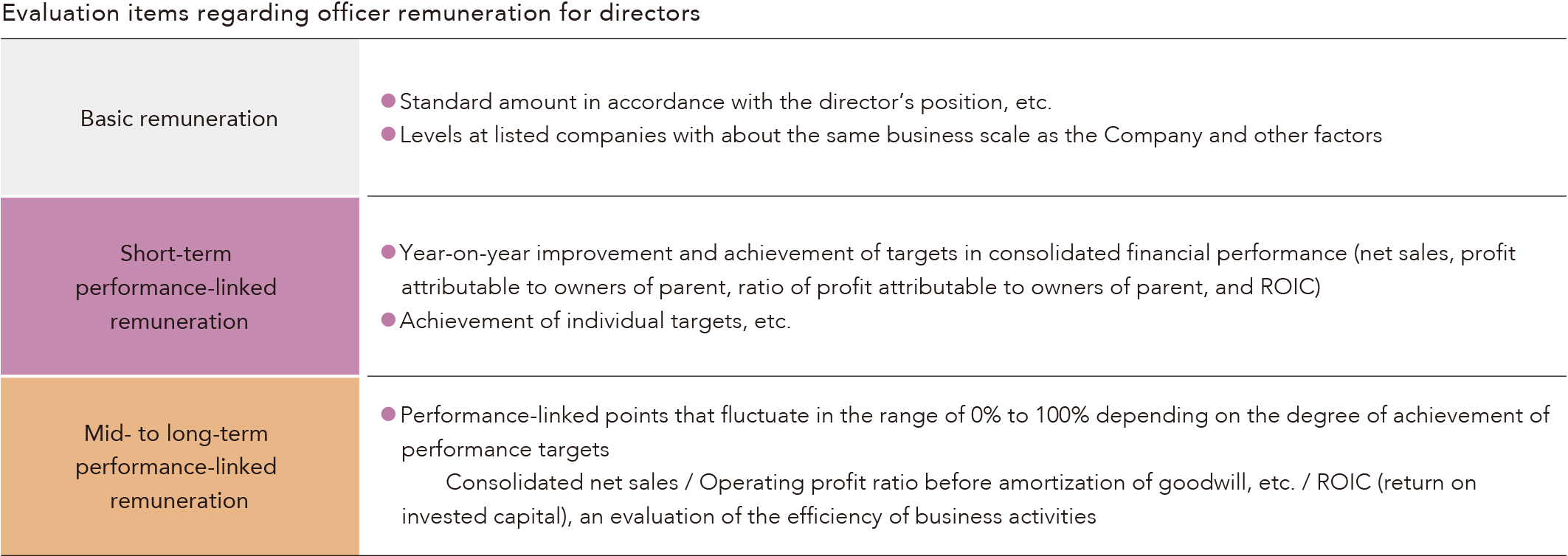

To continuously enhance our corporate value and strengthen our corporate competitiveness, the remuneration of directors is ranked and structured in consideration of such factors as securing and retaining talented human resources and increasing their motivation to achieve better business performance.

The decision on a specific amount of remuneration for directors is delegated to the president by the Board of Directors and the president, upon receiving this delegation, decides the basic remuneration and bonus amounts for each director based on the recommendations of the Nomination and Compensation Committee and within the remuneration limit approved by the Shareholders’ Meeting.

The Company also started investigations into linking evaluations of ESG indicators to remuneration systems.

(1) Directors

Remuneration consists of fixed basic remuneration, a short-term incentive in the form of a performance-linked annual bonus, and a medium- to long-term incentive in the form of performance-linked share remuneration. Basic remuneration is determined according to the director’s position, considering the standards of other listed companies of similar business scale to the Company. Performance-linked remuneration consists of annual bonuses (short-term performance-linked remuneration) and share remuneration (mid -to long-term performance-linked remuneration). Share remuneration is provided through a performance-linked share remuneration plan, under which shares are granted based on the number of points accumulated upon the director’s retirement.

(2) Corporate auditors

Corporate auditor remuneration is determined by discussion among the corporate auditors within the range of the amount approved by resolution at the first annual Shareholders’ Meeting, which was held on June 29, 2005. In view of their role and independence, auditors receive only the fixed basic remuneration.

■Total Remuneration Amounts and Directors

■Composition of GS Yuasa Corporation’s Director Remuneration

■Evaluation Items Regarding Officer Remuneration for Directors

In the event of serious misconduct or violation by a director, etc., the Company may, after consultation with the Nomination and Compensation Committee and by resolution of the Board of Directors, demand that the director, etc. in question forfeit or return their compensation.

The Group believes that holding shares other than pure investments, which are expected to maintain medium- to long-term relationships with investees, expand transactions, and generate synergies, will contribute to the Company’s sustainable growth through the smooth promotion of business activities and expansion of transactions, as well as contribute to the development of the local economy by maintaining and deepening good relationships with the local community. Therefore, the Group’s policy is to hold in principle those shares for which the overall rationality of the holding, including economic rationality, can be confirmed, in addition to the significance of such holdings. The Board of Directors of GS Yuasa Corporation annually verifies the rationality of each individual issue of specified investment shares held, focusing on the following points. Based on these policies, we will reduce holdings of stocks deemed to lack justification for continued ownership as appropriate following verification.

| Qualitative Information | ・Status of business relationship |

| ・Significance of holding other than business relationship | |

| ・Possibility of future transactions and alliances | |

| ・Risks of disposing of shares | |

| Quantitative Information | ・Most recent trading volume and profit amount |

|

・Annual amount of dividends received, gains, or losses on valuation of shares |

Regarding the voting rights of shares held as cross-shareholdings, the Company exercises voting rights after comprehensively assessing the reasonableness of the proposals of the investment target company from the perspective of enhancing corporate value over the medium to long term.

About our Group’s Risk Management, please refer to the following URL.

To strengthen the management foundation, the GS Yuasa Group has improved the system and relevant rules to ensure the maintenance of ethical business practices based on the Companies Act. This system includes mechanisms to ensure effective auditing, information management, and risk management throughout the Group.

To comply with the internal control reporting system required under the Financial Instruments and Exchange Act, we are maintaining an internal control system and financial reporting mechanisms to meet all requirements.

Our international subsidiaries and other consolidated Group companies evaluate the status of the improvement and implementation of internal controls. Following external audits, reports on these internal controls are publicly disclosed.

In order to protect the corporate assets of the Group and promote management efficiency, the department in charge of auditing-related tasks conducts internal audits on a regular basis.

Through these internal audits, we verify and evaluate the legality, suitability, and appropriateness of the organization, systems, and business activities of domestic and overseas Group companies with respect to relevant laws and regulations, company rules, and corporate ethics standards (including anti-corruption) approximately once every three years. Based on the results of verification and evaluation, the Company provides guidance for improvement and offers advice and proposals for rationalization, thereby ensuring thorough legal compliance and improving business activities. The results of internal audits are promptly reported to the president of the directors and relevant personnel (directors in charge, departments in charge, etc.), and information is shared with corporate auditors for the exchange of opinions in order to realize highly effective audits in cooperation with corporate auditors.

■Scope of Internal Audit

|

Division |

Scope |

|

Operational audit |

Auditing the legality, appropriateness, and efficiency of the Group's business activities in accordance with relevant laws and regulations, management policies, ethical standards, and company rules |

|

Accounting audit |

Examine vouchers and other documents related to accounting and audit the legality and appropriateness of accounting records prepared based on such documents |

|

Special audit |

Audits of matters specifically ordered by the president of the directors, other than operational and accounting audits |

Natural disasters, plant fires, and supply chain disruptions have occurred in recent years, and responding to risk has become critical as an aspect of corporate social responsibility. Accordingly, to promote BCP responses, in FY2021, the Group launched a BCP project led by the Environmental Management, Occupational Health & Safety Division with personnel from other divisions and set up a BCP system in FY2023. (BCP manual preparation, business impact analysis, and the creation of an employee safety confirmation system)

In April 2024, we established a Business Continuity Policy, and to ensure more effective activities, we launched quarterly BCP Promotion Meetings (with Group-wide participation). In June of the same year, we distributed Survival Cards (emergency response guidelines during disasters), summarizing safety and disaster response information to all employees to promote BCP awareness internally. Furthermore, in November, we conducted a departmental countermeasures headquarters drill simulating a Nankai Trough-scale earthquake, and in February 2025, we held our first group countermeasures headquarters drill for executives.

For fiscal year 2025, in addition to the activities of fiscal year 2024, we plan to distribute educational videos for all employees and conduct communication drills for executives, aiming to enhance the effectiveness of the group-wide BCP promotion framework.